capital gains tax rate australia

If you do not pay income tax in Australia the purchaser will withhold 125 of the purchase price for ATO. The annual threshold is 1850000.

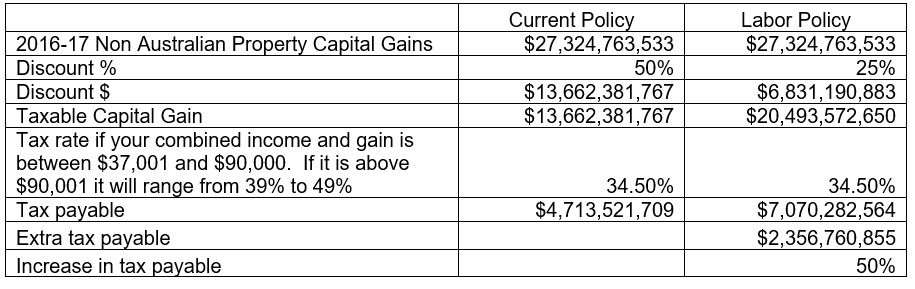

Is Bill Shorten S Changes To Capital Gains Tax Just Revenue Raising

The CGT position for all your holdings sold within the period.

. Web However if the asset is owned by a company the company is not entitled to any CGT discount and youll pay a 30 tax on any net capital gains. Some assets are exempt from CGT such as your home. Web You must then work out five-tenths of the capital gains tax which is 28125.

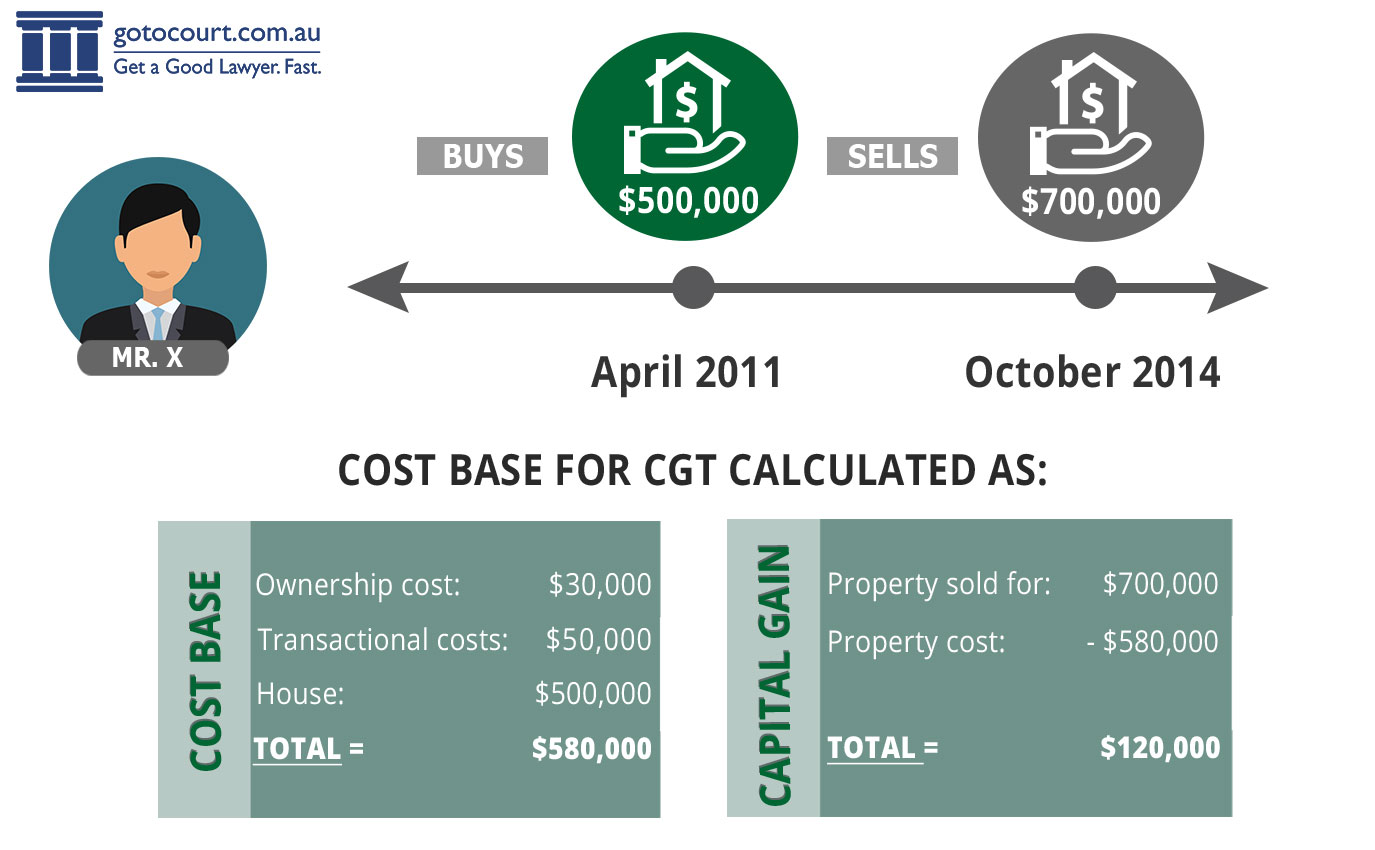

How to get a clearance certificate or withhold on properties sold for 750000 or more. Web CGT operates by treating net capital gains as taxable income in the tax year in which an asset is sold or otherwise disposed of. Web The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations.

Web There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more. Web Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the company. Web In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Web Sharesights award-winning investment portfolio tracker includes a powerful Australian capital gains tax report that functions as a CGT calculator determining capital gains made on sold shares as per Australian Tax Office ATO rules. If your business sells an asset such as property you usually make a capital gain or loss. The rate of payroll tax is 685.

01 Jul 2022 QC 66058. From 1 July 2014. Web Learn about capital gains tax CGT what a CGT event is and ways to reduce your capital gain.

Check if you meet the life events test as a foreign resident to exempt your home from CGT. There are links to worksheets in this guide to help you do this. Web Capital gains is treated as part of your income tax.

It is probably somewhere between 30 to 50. If I tell you what it is you will mock me. Clearance certificates and withholding from property sales.

Web Effective Tax Rate This is the rate at which you are taxed for the capital gains and depends on your income during the financial year. This means you pay tax on only half the net capital gain on that asset. If an asset is held for at least 1 year then any gain is first discounted by 50 for individual taxpayers or by 333 for superannuation funds.

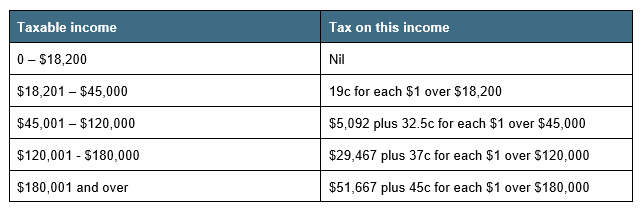

If youre an individual the rate paid is the same as your income tax rate for that year. Establish the date you buy or acquire an asset your share of ownership and records to keep. Payroll taxes in New South Wales.

Capital Gain Tax Rate. I have 3 to 6 months cash on hand and with a stretch am able to put 2k per month in shares. Use the calculator or steps to work out your CGT including your capital proceeds and cost base.

How and when CGT is triggered such as when an asset is sold lost or destroyed. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. You may run the report over any period to see.

What to do when a foreign resident sells Australian real estate worth more than 750000. Web If you own the asset for longer than 12 months you will pay 50 of the capital gain. For example if John earns 110000 AUD from his job as a Software Developer but also made a profit of 15000 AUD this would bring his income total to 125000 AUD.

Web How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. It forms part of the income tax structure with capital profits as calculated and adjusted being added to taxable income and taxed at the taxpayers marginal rate. Check if your assets are subject to CGT exempt or pre-date CGT.

Web If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. Web Payroll taxes in Australian Capital Territory. Web Main residence exemption for foreign residents.

Capital losses can be offset against capital gains. The monthly threshold is 15416666. Web Use the cost thresholds to check if your capital improvements are subject to CGT.

I really want a thing. In the same way that capital gains tax applies if youre renting out a property in Australia you might also be expected to pay capital gains tax if you use your main residence located in Australia for business purposes. If you are an individual you may prefer to use the shorter simpler Personal investors guide to.

How and when CGT is triggered such as when an asset. And for an SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. Web What is capital gains tax.

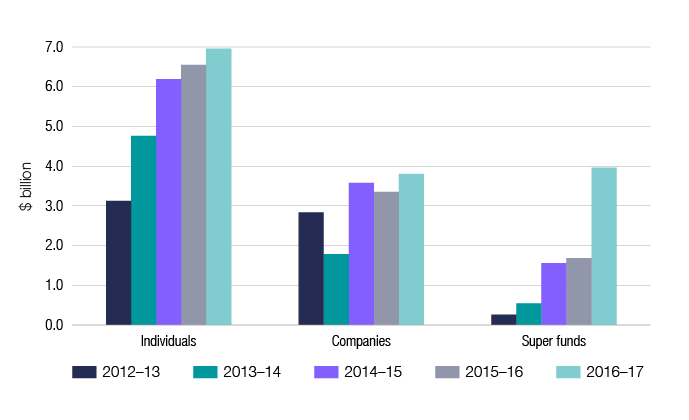

Impacts on foreign and Australian residents. Capital Gains tax in Australia is not a separate tax. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

Web So my situation is that I have a pretty stable job but also a big mortgage. You will need to complete a tax return to claim it back. Capital Gains Tax Estimate An approximation of the amount of capital gains tax you need to pay to the government for the sale of your property.

51667 plus 45c for each 1 over 180000. If you sell a house in Australia add the capital gain to your tax return for that financial year. Establish the date you buy or acquire an asset your share of ownership and records to keep.

This is the difference between what it cost you and what you get when you sell or dispose of it. Capital gains are taxed at the same rate as taxable income ie. Check if your assets are subject to CGT exempt or pre-date CGT.

CGT is the tax that you pay on any capital gain. Australia Corporation Capital Gains Tax Tables in 2022. If you earn 40000 325 tax bracket per year and make a capital gain of 60000 you will pay income tax for 100000 37 income tax and your capital gains will be taxed at 37.

Your crypto gains are to be included in your overall income declaration for the financial year. Web The Capital Gains Tax CGT regime was introduced in Australia with effect from 20 September 1985.

Australia Tax Income Taxes In Australia Tax Foundation

Capital Gains Tax Building Depreciation Home Property Management Residential Property Management In Launceston Tasmania

Tax Rates In Us And Australia Download Table

Capital Gains Tax Australian Taxation Office

Tax Rates In Us And Australia Download Table

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Tax Cgt Calculator For Australian Investors

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

A Brief History Of Australia S Tax System Treasury Gov Au

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

End Of Financial Year Guide 2021 Lexology

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Calculating Capital Gains Tax Cgt In Australia

Australia Tax Income Taxes In Australia Tax Foundation

6 Resident Versus Non Resident Tax Status

2019 Year End Tax Planning Guide Mazars Australia